Reports Q4 (Sep) earnings of $7.05 per share, $0.22 worse than the Capital IQ Consensus Estimate of $7.27; revenues rose 39.0% year/year to $28.27 bln vs the $29.28 bln consensus, 63% of rev from outside U.S. Co issues upside guidance for Q1, sees EPS of $9.30 vs. $8.97 Capital IQ Consensus Estimate; sees Q1 revs of $37.0 bln vs. $36.64 bln Capital IQ Consensus Estimate. Q4 gross margins of 40.3% vs Street est of 39.9% and 38.0% guidance; 17.07 mln iPhones sold in Q4 vs Street est of ~21 mln; 11.12 mln iPhones sold in Q4 vs Street est of ~12 mln; reports 4.89 mln Macs sold in Q4 vs Street est of ~4.5 mln. "Customer response to iPhone 4S has been fantastic, we have strong momentum going into the holiday season, and we remain really enthusiastic about our product pipeline."

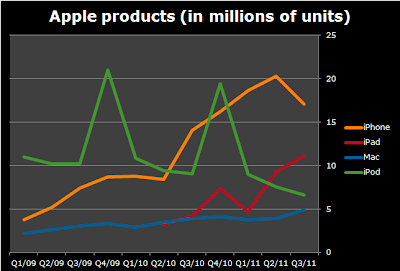

Here's an update of products sold

As can be seen the sale of iPhones has decreased significantly from over 20 million units to 17. Now thinking back this shouldn't be a surprise since Apple reported record sales of its newest model iPhone 4S - they sold 4 million iPhones within one weekend (in October). Customers were probably waiting for the newest model. Just see for yourself how sales of iPads and Macs have increased. Now I can only imagine what the fourth quarter will be for Apple since Christmas is coming. The company themselves gave a guidance of $9.3 EPS vs $8.97 consensus.

The stock price should see some support on 398-400 area since psychologically it is an important level and it is also the area of Fibonacci 61,8 level (if you're fan of TA). Stronger support level should be in the 380-s so if we fall through 400 don't expect any serious resistance until that level.

No comments:

Post a Comment